Business Inquiries Email: thcaptain1013@protonmail.com

Follow on X: @cryptozone1013

Telegram: DadDefi1013

Krystal Finance Tutorial | Automated Liquidity Manager: Optimize Yield Farming Strategies in DeFi

0

1

0

https://www.youtube.com/watch?v=m6KSjlo-9Tg&t=36s

Time is money, especially in the fast-paced world of decentralized finance (DeFi). Managing liquidity can be overwhelming, requiring constant monitoring of pools, impermanent loss, fees, and market fluctuations. This is where automated liquidity management tools come into play, such as VFAT on the Base Network. (CHECK OUT OUR V-FAT ARTICLE and VIDEO HERE) They help streamline the process, saving time while optimizing earnings. Today, we’ll explore how to use Crystal Finance on the Solana network to manage liquidity efficiently.

What is Liquidity Management in DeFi?

Liquidity management is the practice of providing assets to liquidity pools on decentralized exchanges (DEXs) to earn passive income from trading fees and farming rewards. The challenge? Choosing the right pools and managing your positions effectively to avoid unnecessary losses.

Introducing Krystal Finance

Crystal Finance is an automated liquidity management system designed to help yield farmers and liquidity providers track pools, monitor impermanent loss, and optimize rewards. It simplifies the process by automatically rebalancing positions and reinvesting earnings. While it charges fees for these services, it saves users time and effort in managing their portfolios.

How to Find the Best Liquidity Pools | Yield Farming Strategies

Finding high-performing liquidity pools is essential for maximizing earnings. Here are some key factors to consider:

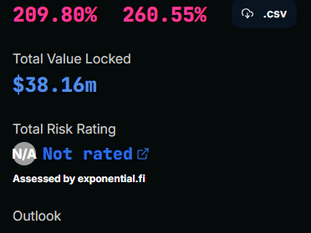

Total Value Locked (TVL) – Look for pools with a high TVL, typically above $200,000, as they tend to be more stable.

24-Hour Volume – A high volume relative to TVL indicates strong trading activity and better fee earnings.

APR Breakdown – Check how much of the APR comes from fees versus farming rewards. Sustainable pools have a higher percentage of fees.

Price Volatility – High volatility increases impermanent loss risks, so assess whether the potential rewards justify the risk.

Pair Selection – Pairing stable assets or assets with high correlation can help reduce impermanent loss.

Using Krystal Finance to Manage Liquidity on Solana

Krystal Finance allows users to explore and filter pools based on TVL, volume, and APR. Here’s a step-by-step guide to identifying profitable pools on Solana:

Set Filters: Adjust TVL and volume to only show pools with at least $200,000 locked.

Analyze APR: Check the breakdown of farming vs. fee rewards.

Monitor Price Volatility: Pools with lower volatility reduce impermanent loss risks.

Adjust Liquidity Range: Setting a balanced range helps optimize earnings while minimizing risk.

Deploy Capital: Once satisfied, add liquidity to the chosen pool and monitor performance over time.

The Trade-off: Fees vs. Time Saved

While tools like Crystal Finance automate the liquidity management process, they charge fees for swaps, rebalancing, and withdrawals. Frequent adjustments can eat into profits, so it’s essential to balance convenience with cost efficiency.

For beginners, it’s advisable to first learn how to manually manage liquidity before relying on automation. Much like learning math, understanding the fundamentals before using a calculator leads to better long-term success.

Final Thoughts

Automated liquidity management tools like Crystal Finance make it easier to participate in DeFi without the need for constant oversight. By filtering for the best pools, managing impermanent loss, and setting smart liquidity ranges, investors can maximize returns while minimizing risks. However, understanding how these tools work before using them is crucial to making informed investment decisions.

If you found this guide helpful, be sure to check out our educational resources at DADS DeFi SPACE and follow us on X for more insights into decentralized finance!

About Kevin: A teacher by profession and a father by choice, my true passion lies in unlocking the vast potential of cryptocurrencies and DeFi. My aim is to educate and inspire anyone eager to explore or understand the myriad opportunities within this dynamic space., and get closer to financial freedom

Stay Connected & Dive Deeper into DeFi

Hungry for more insights and updates? Check out these resources to level up your crypto and DeFi journey:

FREE DeFi and Crypto NEWSLETTER: Stay ahead of the curve with market updates, strategies, and tips 👉 dadsdefispace.org JOIN our private GROUP -CLICK HERE To see how I'm approaching investing this Bull RUN

Make sure to subscribe to our YouTube channel so you never miss a crypto and defi video or update. DADS DEFI SPACE YOUTUBE CHANNEL

Follow on X: Get real-time updates a 👉 x.com/cryptozone1013

B

est Private DeFi Group Around: Gain exclusive access to premium DeFi strategies and guidance. Get 20% off your first month +$50 USDT IF YOU MENTION YOU WERE REFERRED BY: Kevin DADS DeFi Space👉 Join Here UIG Investor GROUP - CRYPTOLABS RESEARCH

I’d love to hear your thoughts! Leave a comment or question below and join the conversation.

DISCLAIMER: The information contained herein is for entertainment and informational purposes only and not to be construed as financial, legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies and defi poses considerable risk of capital loss. The speaker does not guarantee any particular outcome.

© 2024 DAD DEFI SPACE