Business Inquiries Email: thcaptain1013@protonmail.com

Follow on X: @cryptozone1013

Telegram: DadDefi1013

Injective (INJ) and the Power of DeFi Lending: A Bullish Case for Leverage in a High-Conviction Asset

0

1

0

Do Your Own Research: The Key to Conviction

Before we dive into today’s topic, let’s get one thing straight—crypto and DeFi are incredibly risky. You can lose everything, so never invest more than you can afford to lose. Doing your own research (DYOR) is the foundation for building conviction, and conviction is what separates successful investors from those who panic in downturns.

Now that we’ve covered that, let’s explore an advanced leveraged DeFi lending strategy using Injective (INJ) to maximize gains in a bullish market.

Injective: A Hidden Gem Ready to Surge?

Injective ($INJ) has been in a massive downtrend since its recent high of $35.27, now trading just below $13. While some might see this as a bearish signal, I see opportunity.

📉 Current price range: ~$13📈 Accumulation zone: $9.34 - $13🚀 Cost basis: ~$19 (currently underwater but still confident in INJ’s long-term potential)

🔹 The Bullish Case for Injective:

Injective is a core part of the Cosmos ecosystem, leveraging interoperability and scalability.

Hydro Protocol and Neptune Finance are building new DeFi functionalities around INJ, allowing users to stake, borrow, and leverage their holdings.

Growing adoption and ecosystem development suggest that Injective could see a strong recovery when the market turns bullish.

Given this, I’m not only accumulating INJ with cash, but also leveraging my existing holdings to acquire more using DeFi lending strategies.

The Strategy: Leveraging Injective Using DeFi Lending

If you’re bullish on an asset like Injective, there are multiple ways to increase exposure without selling your existing holdings. Let’s break down the steps:

Step 1: Depositing INJ into Neptune Finance

Neptune Finance is a Cosmos-based DeFi protocol supported through Injective. It allows users to lend, borrow, and stake assets while using the Pyth Oracle—a key price feed also used in Solana’s DeFi ecosystem.

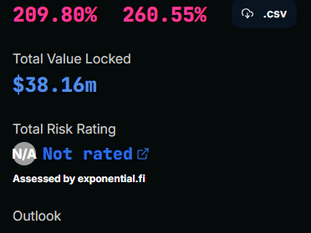

📌 Neptune’s Key Stats:

$12M total deposits

$4M borrowed

INJ and SAY are supported assets

I started by depositing 46 INJ as collateral along with 10 liquid-staked INJ (H-INJ) into Neptune. This allows me to borrow stablecoins (USDC) against my holdings.

Step 2: Borrowing USDC Against INJ Holdings

Instead of selling my Injective, I borrow against it using Neptune Finance.

✅ Loan-to-Value (LTV) Ratio: 1.29 (liquidation at 1.0)✅ Amount borrowed: ~$400 in USDC✅ Risk management: Keeping LTV above 1.5 to avoid liquidation

At this point, I have additional stablecoins that I can deploy back into Injective—without having to sell my initial holdings.

Step 3: Liquid Staking INJ on Hydro Protocol

Now, let’s double-dip by using Hydro Protocol, a liquid staking platform on Injective.

Liquid staking allows me to earn yield on staked INJ while keeping it liquid.

Instead of just staking INJ, I can borrow against my liquid-staked INJ and use it to acquire more INJ.

📌 Steps Taken:1️⃣ Deposit staked INJ on Hydro Protocol2️⃣ Use H-INJ as collateral3️⃣ Borrow more USDC4️⃣ Swap USDC back into INJ

This creates a looped leverage position where I’m earning staking rewards, borrowing against staked assets, and accumulating more INJ.

Risk Management: Avoiding Liquidation in a Bearish Market

📉 DeFi leverage is dangerous in a bear market. If Injective drops too much, I could get liquidated, losing part of my holdings.

To mitigate this:

I keep my loan-to-value (LTV) ratio above 1.5

I only borrow in amounts I can repay if the market turns against me

I watch Neptune’s liquidity to ensure I can exit my position if needed

"Never use these methods in a bearish market… unless you carefully monitor your loan-to-value ratio."

This is why protocol liquidity matters. Neptune Finance has only $12M TVL, meaning I need to be aware of my ability to exit positions quickly.

Final Steps: Redeploying Profits and Preparing for the Next Bull Run

Once Injective’s price begins recovering, the strategy shifts from accumulation to profit-taking:

1️⃣ Sell part of the borrowed INJ into USDC to pay down debt

2️⃣ Lower loan exposure as Injective climbs higher

3️⃣ Hold remaining INJ for long-term appreciation

This strategy allows me to ride Injective’s price increase with leveraged exposure while ensuring I’m not overextended in case of a pullback.

The Big Picture: Why INJ Could Lead the Next DeFi Boom

Injective’s fundamentals remain strong, and with more protocols like Neptune Finance and Hydro integrating with it, DeFi adoption is growing.

Institutional interest in Cosmos-based projects is increasing

DeFi derivatives and leverage trading are gaining traction

Liquid staking will play a major role in the next bull cycle

While leveraged DeFi strategies require careful risk management, they offer huge upside when executed correctly in a strong market.

Injective might be trading lower now, but when the market turns bullish, leveraged strategies like these could amplify gains significantly.

Key Takeaways: The INJ Leverage Strategy in a Nutshell

✔ Injective is undervalued but has strong long-term potential✔ DeFi lending on Neptune Finance allows borrowing against INJ holdings✔ Liquid staking on Hydro Protocol provides additional yield & leverage✔ Risk management is critical—always monitor LTV ratios and liquidity✔ When INJ recovers, profits can be redeployed to pay down debt and secure gains

Final Thoughts: If you’re bullish on Injective and believe in its future, leveraging DeFi lending can increase exposure without selling. But remember—never over-leverage in a bearish market.

About the Writer: Kevin: A teacher by profession and a father by choice, my true passion lies in unlocking the vast potential of cryptocurrencies and DeFi. My aim is to educate and inspire anyone eager to explore or understand the myriad opportunities within this dynamic space., and get closer to financial freedom

Stay Connected & Dive Deeper into DeFi

Hungry for more insights and updates? Check out these resources to level up your crypto and DeFi journey:

FREE DeFi and Crypto NEWSLETTER: Stay ahead of the curve with market updates, strategies, and tips👉 dadsdefispace.org JOIN our private GROUP -CLICK HERETo see how I'm approaching investing this Bull RUN

Make sure to subscribe to our YouTube channel so you never miss a crypto and defi video or update.

DADS DEFI SPACE YOUTUBE CHANNEL

Private Group Follow on X: Get real-time updates and connect with like-minded investors👉 x.com/cryptozone1013

WEEX Non KYC Exchange 100 dollar bonus with futures deposit 30000 USDT Rewards LIMITED TIME Maker 0% Fees 👉https://support.weex.com/en/register?vipCode=fivy

Best Private DeFi Group Around: Gain exclusive access to premium DeFi strategies and guidance. Get 20% off your first month 👉 Join Here UIG Investor GROUP - CRYPTOLABS RESEARCH

I’d love to hear your thoughts! Leave a comment or question below and join the conversation.

DISCLAIMER: The information contained herein is for entertainment and informational purposes only and not to be construed as financial, legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies and defi poses considerable risk of capital loss. The speaker does not guarantee any particular outcome. © 2024 DAD DEFI SPACE